"We continue to repeat the mistakes that led to the collapse of the Roman Empire. It's vital we understand these lessons if we are to safeguard our economic future."

Dr George Maher

With the world facing the greatest public health crisis in living memory and public sector borrowing at record levels, leading economic historian, Dr George Maher, argues that the root causes of many of the economic disasters of our time are much the same as those of the Roman Empire.

His thought-provoking new book offers the first historical account of the Roman Empire written from a practical business perspective.

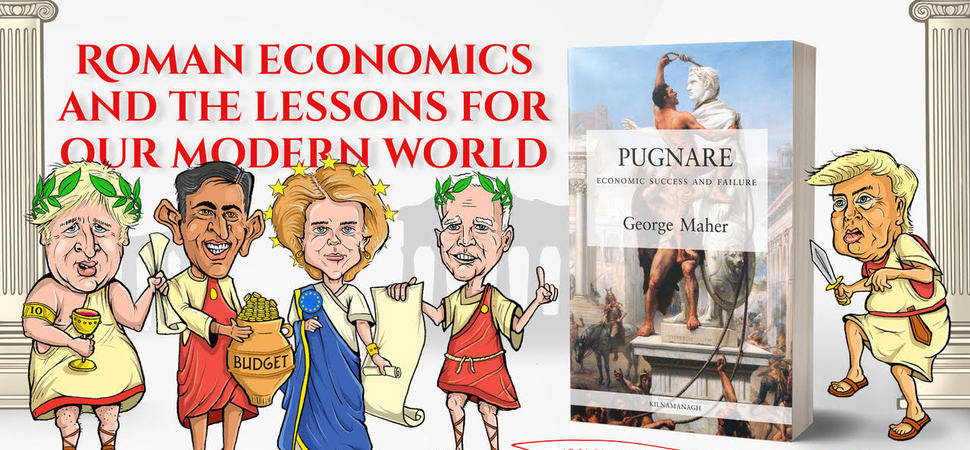

The book, titled Pugnare: Economic Success and Failure, is the first history of the Roman Empire written from a practical business perspective. But it is also about people because business is about people, he says. It offers an insight into the comparative workings of the classical and modern worlds.

George Maher, the author of the book, said: “The economic lessons we can take from ancient Rome are wide-ranging and even offer a foretelling of major events in our recent economic history, including the Great Depression and the 2008 financial crisis.

“In ancient Rome the Financial Crisis of AD 33 was precipitated by an expansion of the money supply under the rule of Augustus and subsequent contraction under Tiberius, which led to a collapse in asset prices, soaring interest rates and economic stagnation. Intervention by the Senate sought to impose lending policies on banks by reducing interest rates and increasing lending to ease the money supply.”

Pugnare’s author, Dr. George Maher, holds a PhD in the economy of the Roman Empire from King’s College London and both a first-class honours BA and MA with distinction in Classics from Birkbeck, University of London. He is a Fellow of the Institute and Faculty of Actuaries and holds a first-class honours degree in Special Honours Mathematics from Trinity College Dublin.

Maher added: “Just as in 2008, the threat Rome faced was systemic and its effects felt throughout the empire. Like a modern-day Ben Bernanke, Tiberius was forced to respond by investing the equivalent of £1bn to bail out the banks offering us a timely insight that economic bailout packages and quantitative easing are far from an unorthodox modern-day construct.

“Similarly, the privatisation of state utilities is by no means a construct exclusive to Britain in the 1980s. Under the Romans, construction and maintenance of the water viaducts were often contracted out to private entrepreneurs wealthy enough to ensure the project’s completion. They worked for a profit. Their contract was with the Senate and local authorities who supervised contract performance.

“Indeed, the lessons extend beyond economics and public sector finance and into political trends. The rise of populism seen across much of the developed world over the past decade, including most notably in the United States with the election of President Trump, can also be observed under the Romans.

“It’s impossible to ignore the similarities between Commodus, the Roman Emperor from AD177 to AD192, and the former President. The parallels extend beyond mere theatrics. Both tenures were defined by unconventionality and erratic leadership, buoyed by teams of unquestioning loyalists.

“Known to many as the Joaquin Phoenix caricature in the cult film, Gladiator, Commodus was a leader “as guileless as any man that ever lived”. Noted to have never known “the touch of common cloth”, such descriptions could easily be mistaken for his modern counterpart.

“It’s also difficult to deny the sizable egos of both figures. Trump’s insistence that he was the 'greatest president since Abraham Lincoln', and his attempt to liken himself to the widely respected Republican, Ronald Reagan, mirrors Commodus’s claims to be the reincarnation of Romulus, Rome’s founder.

“The parallels are extensive, exploring areas ranging from public sector budgeting, the stock market, the origins of the Europe’s first single currency, derivative contracts, cross-border tariffs and trade to the freedom of movement and emergent protectionism.”

George’s book is available to buy from Waterstones.